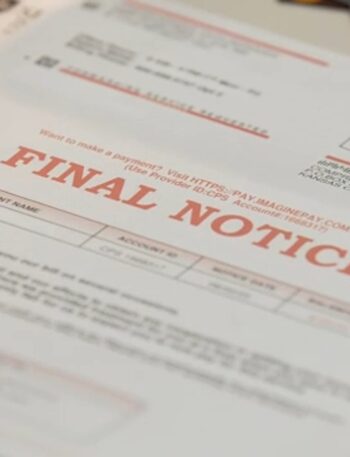

If you have had medical debt in your life you know that it is no joke. Plus, medical debt can be extremely stressful. Many Colorado residents struggle with medical debt. On average, a household in Colorado has over $15,000 in medical debt. One component of medical debt will be changing which will alleviate a lot of stress for residents of Colorado.

Colorado residents already have a significant amount of debt. The average household has $84,730 in unpaid debt. This includes medical debt.

Medical Debt New Policy in Colorado

According to ABC, the Consumer Financial Protection Bureau has finalized new rules and policies that will lead to medical debt not being allowed to appear on credit reports.

ABC believes that the average person with significant medical debt will have their credit scores improve by 20 points.

This would be a federal rule. This means that this would be the policy nationwide. So if you have friends or family that live in other states, you might want to share this news with them.

Related: COLORADO RESIDENTS’ AVERAGE STUDENT LOAN DEBT EXPOSED

This new rule is not set in stone quite yet but has a strong likelihood.

Colorado Takes Credit for New Rule

Colorado happened to be one of the first states that started implementing this rule. It looks like our bold move paid off because the rest of the nation will likely be implementing the rule as well.

If the rule becomes federal, our law that began in 2023 will be protected by federal law. This is great news.

10 Colorado Jobs Most At Risk For Layoffs in 2025

We have gathered various sources to pinpoint which industries are at risk in 2025. These jobs are listed in random order.

Gallery Credit: Tanner Chambers

25 Things Coloradans Can Declutter For the New Year

Getting rid of things can lead to a fresh start.

Gallery Credit: Tanner Chambers