Borrowers are falling behind on their credit card payments as debt for Americans snowballs even more.

Americans saw their credit scores go way up during the covid pandemic which began in 2020, but that was an unprecedented time. Now, higher prices on basic goods and services are hurting people’s pockets, making them rely even more on credit cards and sending them deeper into debt.

WalletHub analyst and writer Chip Lupo said post-covid, inflation took over and started to set people back financially.

“People are relying more on their credit cards to pay for everyday expenses,” he said. “Then what happens is that you create debt that at some point becomes unsustainable.”

According to Lupo, the average credit card debt facing each household is $10,700. The total credit card debt in the U.S. is $1.29 trillion and is expected to go up another $100 billion by the end of the year. The average FICO score for Americans is about 717.

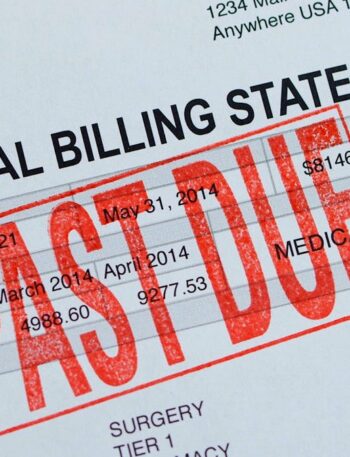

People are also falling behind on other major payments like car payments. Lupo said while most people are only making the minimum payments, some can’t make payments at all.

“When you’re missing payments, your credit score starts to fall, so now you’re in this quandary where you have a low credit score which limits your ability to open new credit, you have less credit to work with and you’re carrying balances with very high interest rates,” said Lupo.

Americans are going to struggle to manage that credit card debt. Lupo makes a few suggestions for folks on how to manage their debt moving forward. The first move is to track income and expenses

“You want to create a budget and stick to it, prioritize your essential spending and your debt payments and cut unnecessary costs,” Lupo said.

Saving gradually to build an emergency fund is also an important step that Lupo suggested for people to combat their debt.