PHOENIX (AZFamily) — When you apply for a mortgage, car, or small business loan, medical debt should no longer stand in your way.

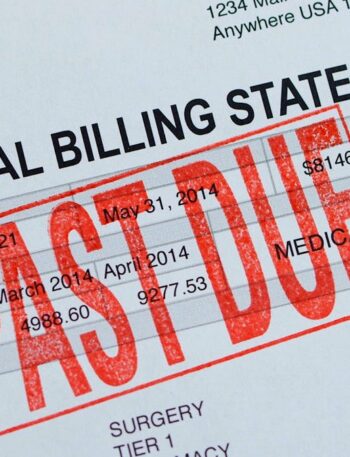

A new federal ruling bans medical debt from lowering a person’s credit score and wipes out billions of dollars of unpaid medical bills for millions of Americans.

This comes after the federal government found that medical debt does not predict a borrower’s ability to repay other debts. Healthcare invoices often have inaccurate, inflated, or extra charges, so experts say you should always ask for an itemized receipt.

Life is good these days for Arizona resident Matt Miller. The husband and father became a first-time homeowner two years ago, at age 41. But it wasn’t easy to get here.

Medical debt wrecked his credit score, so much so that for most of his life, getting a car loan or mortgage was just about impossible.

“In my name, right. So, I’ve always had to have a co-signer,” said Miller.

He tells me he owed about $20,000 in medical bills.

The former ASU football player was born with a cleft palate and has undergone numerous surgeries to repair that and several ACL tears.

Growing up, it was a major financial burden on his parents and in his 20s and 30s, he said it felt like the weight of the world was on his and his wife’s shoulders.

“I finally pulled myself out of that hole with working my butt off to get to where I am now. Paid everything off,” said Miller.

Charles Parker of AZ Credit Medix helped give his FICO score the boost it needed.

“You’re not taught anywhere, but it runs your life. And the minute you mess up, you can’t get nothing,” said Parker. “I would say about 90% of all credit reports have medical debt.”

The Biden Administration says medical debt is the largest source of debt in collections. More than 100 million Americans struggle with it.

The White House announced this week that $49 billion of unpaid medical bills will be removed from the credit reports of 15 million Americans.

This new rule means lenders can no longer use medical information against you.

“It’s tremendous for families that are going through situations like I went through. That’s going to help out tremendously because now they can actually afford to do things,” said Miller.

The Consumer Financial Protection Bureau says this move will raise millions of credit scores by an average of 20 points and lead to the approval of around 22,000 additional mortgages every year.

“I want everybody to have this. It’s wonderful that this is something that’s a possibility right now. Long time coming,” said Miller.

But just because you may no longer see medical debt on your credit report doesn’t mean it doesn’t exist.

Parker said it’s vital that you pay back what you owe to avoid a court-ordered judgment from a debt collector. He says that would set you back significantly and cause way more financial hardships down the line.

See a spelling or grammatical error in our story? Please click here to report it.

Do you have a photo or video of a breaking news story? Send it to us here with a brief description.

Copyright 2025 KTVK/KPHO. All rights reserved.