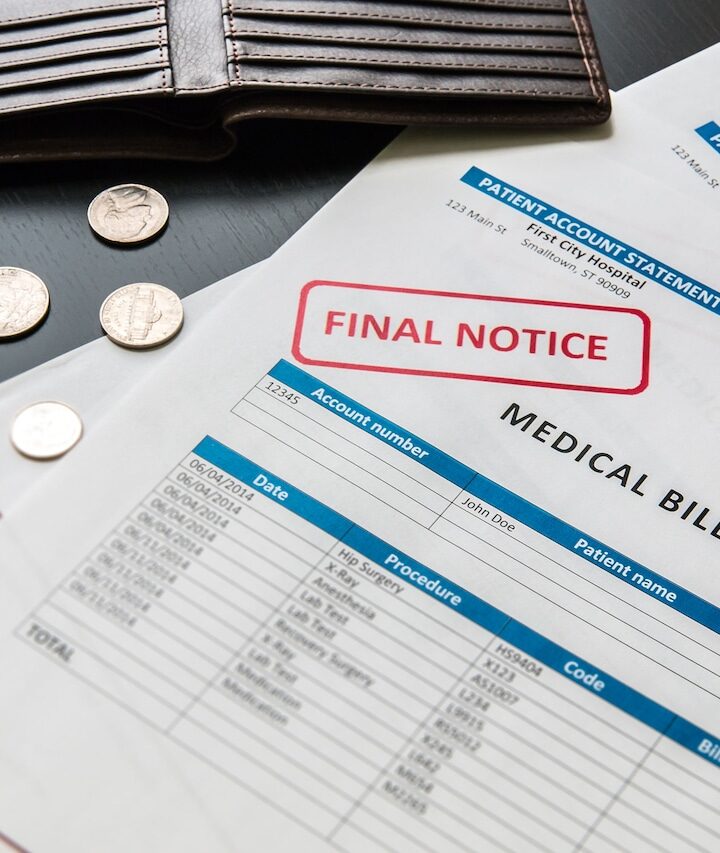

Medical debt — a burden for nearly 15 million people in the country — will no longer haunt consumers’ credit reports, according to a new federal rule that was finalized on Tuesday.

The Consumer Financial Protection Bureau announced that lenders will no longer have access to medical debt information when a consumer is looking to borrow money. Lenders also will be barred from using medical information from making business decisions, the bureau said.

Medical bills are often inaccurate, Rohit Chopra, the bureau’s director, said in a statement. Medical debts also provide “little predictive value” about borrowers’ ability to pay other bills.

Credit agencies will be required to remove any mention of medical debt when lenders seek a credit report, according to the new rule.

“People who get sick shouldn’t have their financial future upended,” Chopra said.

Even people with health insurance can get slammed by medical debt, which often arises from an unexpected illness or accident, said Patricia Kelmar, senior director for health care campaigns at the Public Interest Research Group, a national consumer advocacy organization that campaigned for the new rule.

“This new rule is good news for at least 14 million Americans – including many financially responsible families who have accumulated medical debt from unpredictable health issues, high out-of-pocket costs, insurance claim denials and billing errors,“ Kelmar said in a statement.

“The Consumer Finance Protection Bureau’s important work on medical debt reporting offers yet another example of how this crucial agency protects consumers from unfair practices,” Kelmar added.

The bureau predicted the rule will translate into roughly 22,000 additional people obtaining mortgages a year and boost the average credit report by 20 points.

Credit scores range from 300 to 850. A credit score of 670 to 739 is considered good, scores of 740 and above are very good and anything 800 and above are excellent.

The rule follows actions taken by the big three credit conglomerates, Equifax, Experian, and TransUnion — following pressure from the bureau — that they exclude some medical debt from credit reports, including debts under $500.

The new federal rule is the latest benefit for New Jerseyans struggling with medical debt.

In July, New Jersey Gov. Phil Murphy signed the “Louisa Carman Medical Debt Relief Act,” a law that prevents medical bill collectors from reporting any unpaid debt in the state to a consumer credit agency accrued on or after July 22.

The law also prevents medical bill collectors from charging an interest rate of more than 3% or garnishing the wages of a patient who earns less than 600% of the federal poverty rate. which amounts to $90,360 for one person.

Patients who comply with a “reasonable” payment plan also will be protected from bill collections, according to the new law.

Susan K. Livio may be reached at [email protected]. Follow her on X @SusanKLivio.