Some Americans with medical debt could soon get a boost on their credit scores.

“Consumer Financial Protection Bureau” made a rule to ban that debt from credit reports. A spokesperson from the bureau says this is an effort to protect consumers.

Kiren Gopal says medical debt is a poor predictor of whether people will repay a loan. He says this will help them gain buying power for big life goals like a house or a car.

“Right now, about 100 million Americans have medical debt,” Gopal said. “It’s really a disaster. It’s the leading cause of bankruptcy.”

“And when it ends up on people’s credit reports, it can end up blocking somebody from getting a mortgage or a job or other big life aspirations, especially when these bills are inaccurate, which they often are,” he added.

With the new ruling, Gopal says 15 million people will have about $49 billion removed.

“The rule itself is very simple. It would prohibit lenders from considering medical bills on your credit report when making a credit decision such as a new mortgage or a car loan,” Gopal said. “And then it would ban consumer reporting agencies from including medical bills on credit reports and credit scores that are sent to lenders.”

The rule will also ban lenders from using medical devices like wheelchairs or prosthetic limbs as collateral for loans. They also can’t repossess them if patients aren’t able to repay the loans.

“When you get sick, the focus should really be on getting better, not on fighting debt collectors who are trying to extort you to pay a bill that you may not even know,” Gopal said. “Especially at a time when you should be able to rest, be with your family, go to a doctor’s appointment. It’s really the worst time possible for having to fight with a debt collector.”

Gopal says the CFPB has been studying the impacts of medical debt for a decade.

He says they finally made the rule after other agencies took steps to minimize the effect.

“And then just a few years ago, 2022, we published some new research about the debilitating, debilitating effects of medical debt,” Gopal said. “And after we published that research, the credit reporting agencies took some steps to remove medical bills from credit reports, but they they didn’t remove all of the medical bills from credit reports. The problem still remained.”

Gopal says he hopes this can provide relief for people during their time of need.

“People really shouldn’t be punished just for getting sick. Nobody chooses to get ill,” he said. “Nobody chooses to have to take a trip to the emergency room. It’s really a tragic part of life when somebody falls ill”

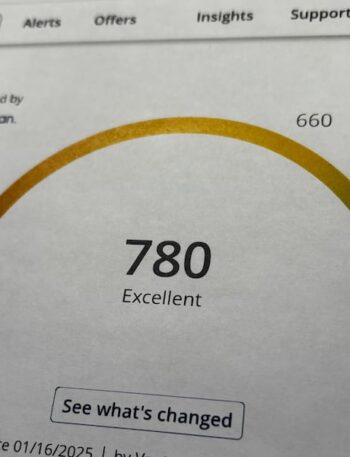

The ruling will take effect in March. He says people could see their credit score boost by about 20 points on average.