The U.S. Consumer Financial Protection Bureau finalized a rule this week that will remove an estimated $49 billion in unpaid medical bills from the credit reports of about 15 million Americans.

The CFPB’s action will ban the inclusion of medical bills on credit reports and prohibit lenders from using medical information in their lending decisions for home mortgages, car loans or small business loans. The rule will also increase privacy protections and prevent debt collectors from using the credit reporting system to coerce people to pay bills they don’t owe.

CFPB research has found that medical debts provide little predictive value to lenders about borrowers’ ability to repay other debts, and consumers frequently report receiving inaccurate bills or being asked to pay bills that should have been covered by insurance or financial assistance programs.

“The CFPB’s final rule will close a special carveout that has allowed debt collectors to abuse the credit reporting system to coerce people into paying medical bills they may not even owe,” said CFPB Director Rohit Chopra on Tuesday when the final rule was announced.

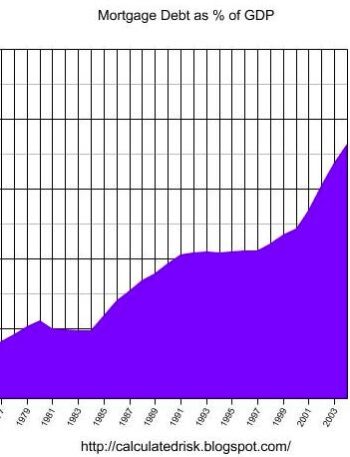

The CFPB expects the rule will lead to the approval of approximately 22,000 additional, affordable mortgages every year and that Americans with medical debt could see their credit scores rise by an average of 20 points.

The CFPB’s action follows changes made in 2023 by the three nationwide credit reporting conglomerates – Equifax, Experian, and TransUnion – who announced that they would take certain types of medical debt off credit reports, including collections under $500.

Major credit scoring companies FICO and VantageScore have also decreased the degree to which medical debt affects a consumer’s score. However, even with the changes, 15 million people in the U.S. still have outstanding medical bills in collections appearing in the credit reporting system, according to the CFPB.

Key provisions of the final rule:

- Prohibits lenders from considering medical information: The rule ends the special regulatory carveout that previously allowed creditors to use certain medical information in making lending decisions. This means lenders will also be barred from using information about medical devices, such as prosthetic limbs, that could be used to require that the devices serve as collateral for a loan for the purposes of repossession.

- Bans medical bills on credit reports: The rule bans consumer reporting agencies from including medical debt information on credit reports and credit scores sent to lenders. This will help end the practice of using the credit reporting system to coerce payment of bills regardless of their accuracy. Lenders will be able to consider medical information to verify medical-based forbearances, verify medical expenses a consumer needs a loan to pay, consider certain benefits as income when underwriting, and other legitimate uses.

The rule will be effective on March 17, which is 60 days after its scheduled publication in the Federal Register.