CLEVELAND — If you have problems with medical bills piling up on your credit report, a new federal rule could help you eliminate future medical debt from your credit reports.

The Consumer Financial Protection Bureau, or CFPB, announced the rule today, but there’s still some work to do.

“I’m very pleased with that ruling,” said Chris Hoyt from Madison giving his initial reaction to banning medical debt from credit reports.

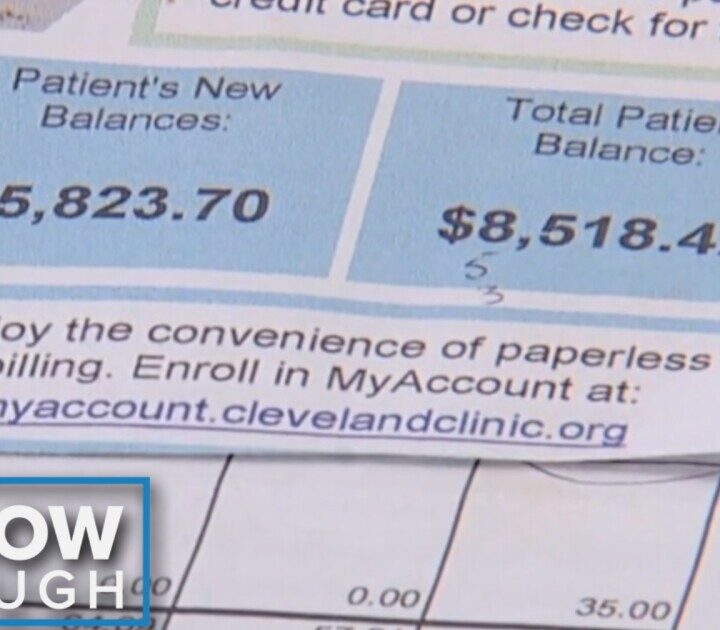

We did a story last year with Hoyt when he had problems with medical billing and was told that if he didn’t pay a bill, it would go on his credit report. He was troubled but not surprised by the threat.

Big medical bill + no real answers = 1 huge headache for former school bus driver

RELATED: Big medical bill + no real answers = 1 huge headache for former school bus driver

“As a retired banker, I used to review credit all the time and medical bills were not uncommon,” said Hoyt.

HOW WOULD THIS HELP?

The CFPB reported that removing medical debt could boost people’s credit scores by 20 points on average and lead to about 22,000 more people getting approved for mortgages.

“We think this is a great day for patients and their families,” said Chuck Bell, a Financial Policy Advocate with Consumer Reports.

He said while medical debt is the leading cause of bankruptcy and the most common source of debt, there’s something interesting about that debt.

“What the CFPB has found is that medical debt is really not predictive of a consumer’s ability to repay loans for a car or a house, for example,” said Bell.

The rule is set to go into effect in 60 days.

HOW DOES THE CREDIT REPORTING ASSOCIATION SEE THIS?

We reached out to the Consumer Data Industry Association or CDIA which represents consumer reporting agencies. In a statement, it said in part, “…the CFPB lacks the legal authority to prohibit creditors from considering medical debt… Congress established a detailed framework governing the content of credit reports….”

Bell said Congress has six months to overturn the rule, but he hopes it does not. “People do work diligently to try to pay (medical debt) off,” said Bell. “And it really hurts if they jack up your interest rates when you’re trying to buy a car so that you can get to work and pay off your debts.”

Hoyt hopes Congress doesn’t, too. “I’m hoping lawmakers and all the principals involved take the high road on this,” he told us.

CDIA said it’s now evaluating options to combat this rule. Click here to read the full statement.

MEDICAL DEBT FORGIVENESS IN NEO

You might remember Cleveland City Council and Akron recently approved money to wipe away medical debt for people living in those cities. So far, reports show that tens of thousands of people have had tens of millions in medical debt removed, which helps their credit reports.

“It’s good that medical debt will no longer be a blight on anyone’s credit score. But that doesn’t make the debt go away,” said Cleveland Councilperson Kris Harsh. “With Cleveland City Council’s efforts, some of that debt will come off your conscience as well as your credit score.”