Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q3 2024 (just released).

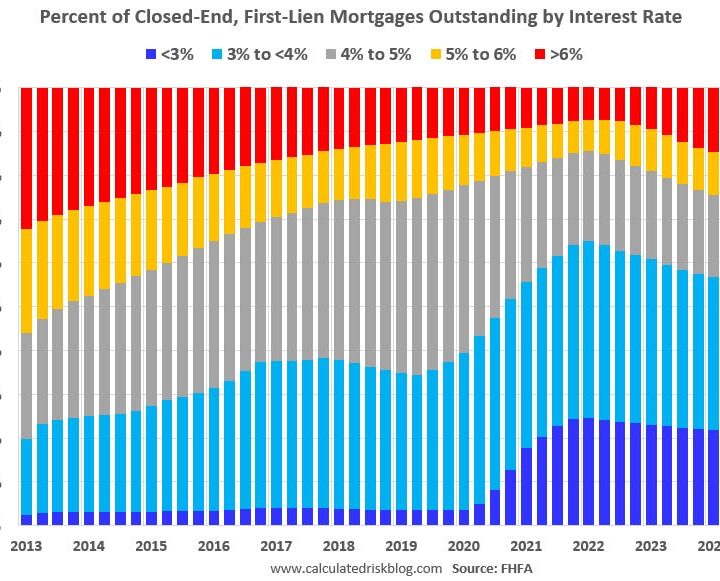

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2024.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.1% (now at 55.2%), and the percent under 5% peaked at 85.6% (now at 73.3%). These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are so low.

The percent of loans over 6% bottomed in Q2 2022 at 7.3% and has increased to 17.2% in Q3 2024.

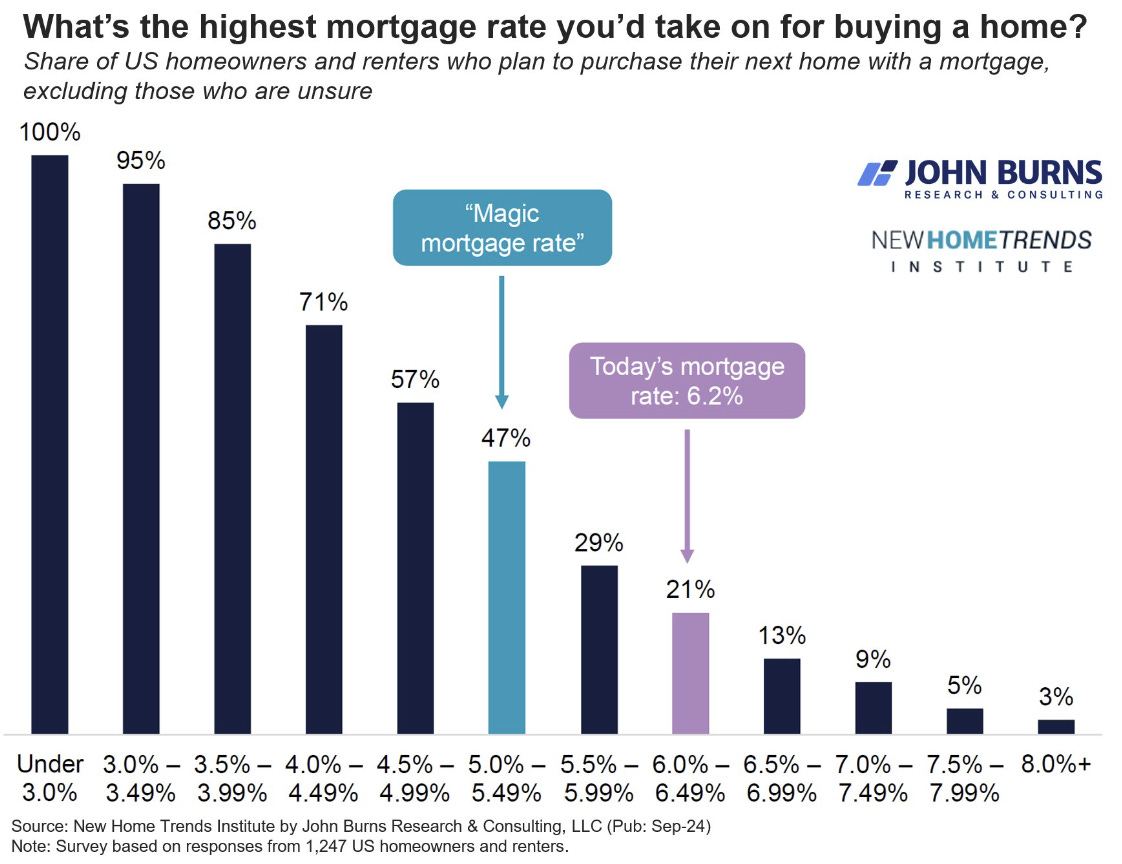

As an aside, Rick Palacios Jr., Director of Research at John Burns Research & Consulting, noted last quarter:

Consumers need mortgage rates to start with a 5 before they dive back into the housing market. We’ve been asking this question for a few years, and the responses haven’t shifted much.

This graph is from last quarter when mortgage rates dipped in the low 6% range. Current mortgage rates are over 7% for a 30-year fixed rate loan.

Back to the FHFA data base: Here are graphs on the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV).

The following content is for paid subscribers only. Thanks to all paid subscribers!