WASHINGTON (TNND) — As the holiday season wraps up, many Americans have a credit card hangover from holiday spending. According to a survey by LendingTree, 36% of Americans took on holiday debt this year, with an average amount of $1,181.

“Inflation is still a big deal in this country, and it’s having a huge impact on people’s finances, including their holiday spending,” explained Matt Schulz, LendingTree’s chief credit analyst. “If you were to only buy the same things you bought last Christmas, you’d likely have to spend more this year thanks to inflation. For many Americans, that means you either have to cut back on gifts or take on more debt. While people make lots of sacrifices to deal with higher prices, many may not want to sacrifice at the holidays, so debts continue to rise.”

Yahoo! Finance also reports that a growing number of consumers are struggling to pay for necessities due to increased costs since the COVID-19 pandemic. As a result, many are relying more heavily on credit cards, personal loans, and buy now, pay later options, which are contributing to deeper financial woes.

According to Money Management International (MMI), 83% of Americans with credit cards struggled to make ends meet this year.

“Americans are clearly feeling the pinch of rising costs,” said Thomas Nitzsche, Sr. Director of Media & Brand at MMI. “More people are turning to us for help as they try to keep up with everyday necessities like groceries and utility bills. We’re seeing firsthand how inflation is driving people to cut back on non-essential spending and seek out debt management solutions.”

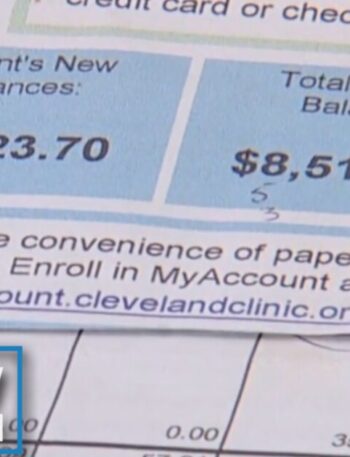

Beyond holiday spending, the Federal Reserve Bank of New York reports that household debt has reached $17.94 trillion. Credit card balances alone increased by $24 billion, reaching $1.17 trillion.

“Although household balances continue to rise in nominal terms, growth in income has outpaced debt,” Donghoon Lee, Economic Research Advisor at the New York Fed said in a press release. “Still, elevated delinquency rates reveal stress for many households, even amid some moderation in delinquency trends this quarter.”

State-by-state differences in credit card usage are also notable. According to WalletHub, Alaska ranks first in credit card ownership, with residents opening an average of 1.4 new cards during the third quarter of 2024. This marks a 5.06% increase in new credit cards compared to the same period in 2023. In contrast, Wyoming has the least number of credit cards per resident.

“Having multiple credit cards in your wallet can be good for your credit score as long as you spend responsibly, keep your credit utilization low, and always pay on time. For example, you can use different credit cards for different purposes, such as separating charges you want to finance from everyday purchases. But if you regularly miss payments or spend beyond your means, you may have too many credit cards,” explained WalletHub Analyst Chip Lupo.