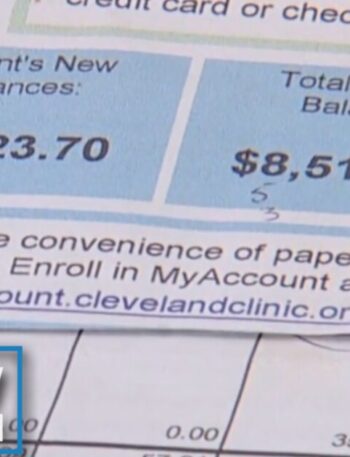

Credit scores took a hit across all 50 states last year, with New York ranking 27th in a new WalletHub analysis of the states with the largest credit score decreases.

The report shows that the average credit score in New York dropped by 0.58% between the third quarters of 2023 and 2024, leaving the state with an average score of 690. While this remains in the “good” credit range, it signals financial challenges for some New Yorkers.

WalletHub’s report sheds light on a nationwide trend of falling credit scores, exacerbated by economic pressures and rising costs of living. Alaska residents experienced the sharpest decline, with their average score falling from 686 to 679, now in the “fair” credit range.

Chip Lupo, a WalletHub analyst, emphasized the importance of proactive credit management to recover from such declines. “Using a credit card regularly and paying the balance in full each month is one of the quickest ways to improve your score,” Lupo said. He also advised keeping credit utilization below 30% and reducing long-term debts to boost financial health.

For those looking to assess how their state fares or to explore detailed credit recovery strategies, the full report is available at WalletHub’s website. Diana Polk, WalletHub’s communications manager, is also offering expert interviews to discuss the findings and implications.

FingerLakes1.com is the region’s leading all-digital news publication. The company was founded in 1998 and has been keeping residents informed for more than two decades. Have a lead? Send it to [email protected].