MILLIONS of Americans will be relieved of their medical debt and may potentially see their credit score rise immediately thanks to a new final ruling.

Nearly $50 billion in unpaid medical bills will be removed from credit reports due to a new move by the Consumer Financial Protection Bureau.

The move means Americans will no longer be penalized for medical debt on credit reports, Vice President Kamala Harris revealed on Tuesday morning.

Fifteen million Americans will see the removal of $49 billion in unpaid medical bills from their credit reports due to a financial ruling by the US government agency.

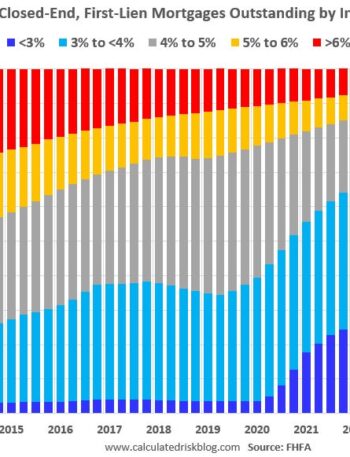

The new financial ruling will remove a large barrier to getting mortgages, car loans, or small business loans, as lenders will no longer be able to consider medical debt when deciding whether to issue a loan.

“No one should be denied economic opportunity because they got sick or experienced a medical emergency,” Harris said.

“We also reduced the burden of medical debt by increasing pathways to forgiveness and cracking down on predatory debt collection tactics.”

This initiative aligns with Harris’ ongoing call to action for states to alleviate the burden of medical debt, which frequently limits access to credit for essential living expenses.

“This will be life-changing for millions of families, making it easier for them to be approved for a car loan, a home loan, or a small-business loan,” she said.

“Our historic rule will help more Americans save money, build wealth, and thrive.”

The vice president also shared that several states and localities are utilizing funds from the American Rescue Plan to help eliminate more than $1 billion in medical debt for over 700,000 Americans.

This will be life-changing for millions of families, making it easier for them to be approved for a car loan, a home loan, or a small-business loan. Our historic rule will help more Americans save money, build wealth, and thrive.”

Kamala Harris

HELPING HAND

The new Consumer Financial Protection Bureau ruling is projected to raise the credit scores of impacted Americans by an average of 20 points, leading to the approval of around 22,000 additional mortgages annually.

The three biggest credit reporting agencies – Experian, TransUnion, and Equifax – announced in spring 2022 that they would stop showing unpaid medical debts under one year old and medical debt under $500 on credit reports.

Although less sizable unpaid medical bills are no longer included on credit reports, having excessive medical debt can largely impact Americans’ ability to be approved for a loan – despite research revealing that medical bills poorly predict a consumer’s ability to pay off a loan.

“Medical debt burdens millions of families across the country and can unfairly tarnish a person’s credit record, making it more difficult to qualify for an affordable loan, get a job, or even rent an apartment,” said Chuck Bell, advocacy program director for Consumer Reports, in a statement.

“Many consumers have medical debt on their credit reports that is inaccurate or under dispute because our medical billing and insurance reimbursement system is so complex and confusing.”

While the new Consumer Financial Protection Bureau ruling removes medical debt from credit reports, the outstanding debts themselves will still need to be paid.

Americans who use credit cards to pay medical bills will still see those unpaid debts on their credit reports, as they are not covered by the ruling.

Although the ruling is positive news for the millions of Americans it aims to help, it may not be permanent.

Harris’ announcement came despite demands from Republicans in Congress for the current administration to stop issuing new rules with President-elect Donald Trump set to take office, as Reuters pointed out.

This means that Trump or his congressional allies may try to reverse the ban on medical bills on credit reports.

Check out these exclusive stories by The U.S. Sun on paying off debt.

A business owner paid off $74,000 debt in less than two years with a “snow” trick and now makes $200,000 annually.

Plus, a gig worker with $40,000 in student loan payments shared the two essential areas they’re cutting back.